-

1. What Is A Tariff? Why Do We Levy Tariffs? Who Applies Customs Tariff?

Tariffs (or customs duties) are a form of tax levied by governments on the importation or exportation of goods. Although they are generally levied on imported goods, some countries levy tariffs and taxes on exported goods in some rare cases.

Tariffs are a source of revenue for governments, more important for least developed economies than for developed ones where other forms of taxes, such as income taxes or Value added taxes (VAT), prevail. Some countries levy tariffs and taxes on exports to encourage businesses to process and to ensure adequate supply of necessary goods within the country. ITC’s Market Access Map provides information on imported goods only.

-

2. Who Pays The Tariffs?

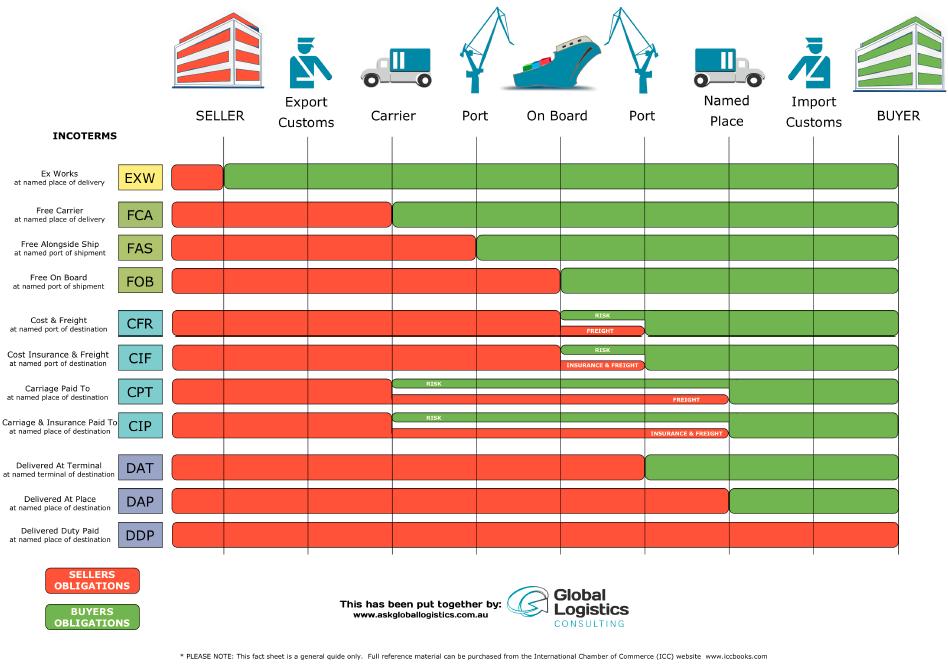

The importer of record pay the customs duties, which generally are levied at the time of imports. In some cases, however, tariffs may be on the exporter’s charge depending on the International Commercial Terms (Incoterm).

Figure 1: Who pays the tariffs based on the Incoterm (2010)

-

3. Institutional framework

The General Agreement on Tariff and Trade (GATT) is the backbone of the modern trading system. It contains the fundamental rules to promote international trade by reducing or eliminating trade barriers such as tariffs or quotas.

The World Trade Organization (WTO) superseded the GATT as an institution on 1 January 1995. However, the GATT as an agreement is still in force and constitutes one of the WTO Agreements.

-

4. Type of tariffs

-

a. Bound tariffs

Every country maintains a tariff schedule setting forth its tariff rates for all imported goods, which are classified based on the Harmonized System (HS).

When a country joins the WTO, it submits its negotiated tariff schedule with all tariff rates on a product-by-product basis, to which it is committed toward the other WTO Members. Those tariffs are “Bound” to those rates meaning that a Member cannot increase its tariff above the bound rate without renegotiating its commitment.

The tariff schedules of developed countries are often complex with tariff treatment varying based on minor differences. Such distinction may reflect specific business interests. On the contrary, the tariff schedules of developing countries are often relatively simpler. Developing countries frequently employ a band system, with a certain level of tariff on raw materials, a higher tariff on components and semi-finished products, and the highest tariffs on finished articles.

-

b. Applied tariffs

A country may impose an actual duty – known as the applied tariff – that is below its bound or ‘ceiling’, rate. For instance, many developing countries have lowered their tariffs on a unilateral basis, but they still have flexibility to raise their tariffs up to the bound rate in the future if they need to protect specific domestic sectors. This practice may create uncertainty for some businesses.

Applied tariffs include MFN, general and preferential tariffs.

Note that the GATT does not impose any limit on the maximum tariff that a member may impose on imports as long as it is within the bound rate.

-

c. MFN tariffs

The MFN principle, set forth in Article I of the GATT, requires that “any advantage, favour, privilege or immunity granted by any contracting party to any product originating in or destined for any other country shall be accorded immediately and unconditionally to the like product originating in or destined for the territories of all other contracting parties”.

The MFN tariffs are therefore the customs duties imposed by a country on any WTO members without discrimination.

The MFN principle is a “cornerstone of the GATT and one of the pillars of the WTO trading system”. However, there are some exceptions (Box 1). For instance, Article XXIV permits WTO Members to form regional trade agreements (free trade areas and customs unions), in which the Members being parties to such agreements may eliminate duties on imports from each other, while maintaining duties on imports from other countries. Another notable exception is the Generalized System of Preferences (GSP) that allow developed countries to provide ‘unilateral’ tariff concessions on imports from developing countries.

Box 1 : EXCEPTIONS TO THE MFN PRINCIPLES - Enabling clause

Derogations from the MFN treatment are conceded to developing countries, in respect of specific conditions, by the signatories of the GATT (i.e. Contracting Parties) Decision of 25 June 1971, relating to the establishment of "Generalized, non-reciprocal and non-discriminatory preferences beneficial to the developing countries" (BISD 18S/24) and the Decision of 28 November 1979 on "Differential and More Favourable Treatment, Reciprocity, and Fuller Participation of Developing Countries" (L/4903), also known as the "Enabling Clause”. - Exceptions for Regional Trade Agreements (in the framework of a customs union or free trade area) – Article XXIV GATS + Enabling clause/Article V GATS.

GATT article XXIV allows countries that are seeking regional integration to reduce their tariffs below their MFN rates if the following conditions are met:- Tariffs and other barriers to trade among the contractors of the agreement must be eliminated substantially for all products within a reasonable period of time;

- Regional integration must not worsen the market access conditions granted to other WTO members prior to the enforcement of the agreement.

- General exceptions (protect human, animal or plant life or health)

The measures are not applied in a manner which would constitute a means of arbitrary or unjustifiable discrimination between countries where the same conditions prevail, and it is not a disguised restriction on international trade) – Article XX GATT/Article XIV GATS - Security exceptions

In order to protect national security interests. – Article XXI GAT/Article XIVbis GATS/Article 73 TRIPS - Balance-of-payments

Right to take measure to safeguard a Member’s external financial positions. – Article XII GATT/Article XII GATS - Waivers

Temporary waivers granted with the authorization of the other Members – Article IX:3 of the Marrakesh Agreement establishing the WTO

- Enabling clause

-

d. Preferential tariffs

Preferential tariffs are customs duties lower than the MFN tariffs, levied on imports from trading partners that have preferential arrangements (reciprocal and non-reciprocal) with the importing country.

Note that preferential rates agreed between countries may not cover all traded products. Businesses should therefore first ascertain whether a product is eligible for any preferential tariffs and then determine whether, from a cost-benefit perspective, it is better to take advantage of MFN treatment or preferential treatment. In some instances indeed, the administrative costs of gaining preferential treatment, particularly the compliance to criteria outlined in the rules of origin, outweigh the benefits of the MFN treatment that may be available under a preferential trade regime.

-

e. Form of tariffs

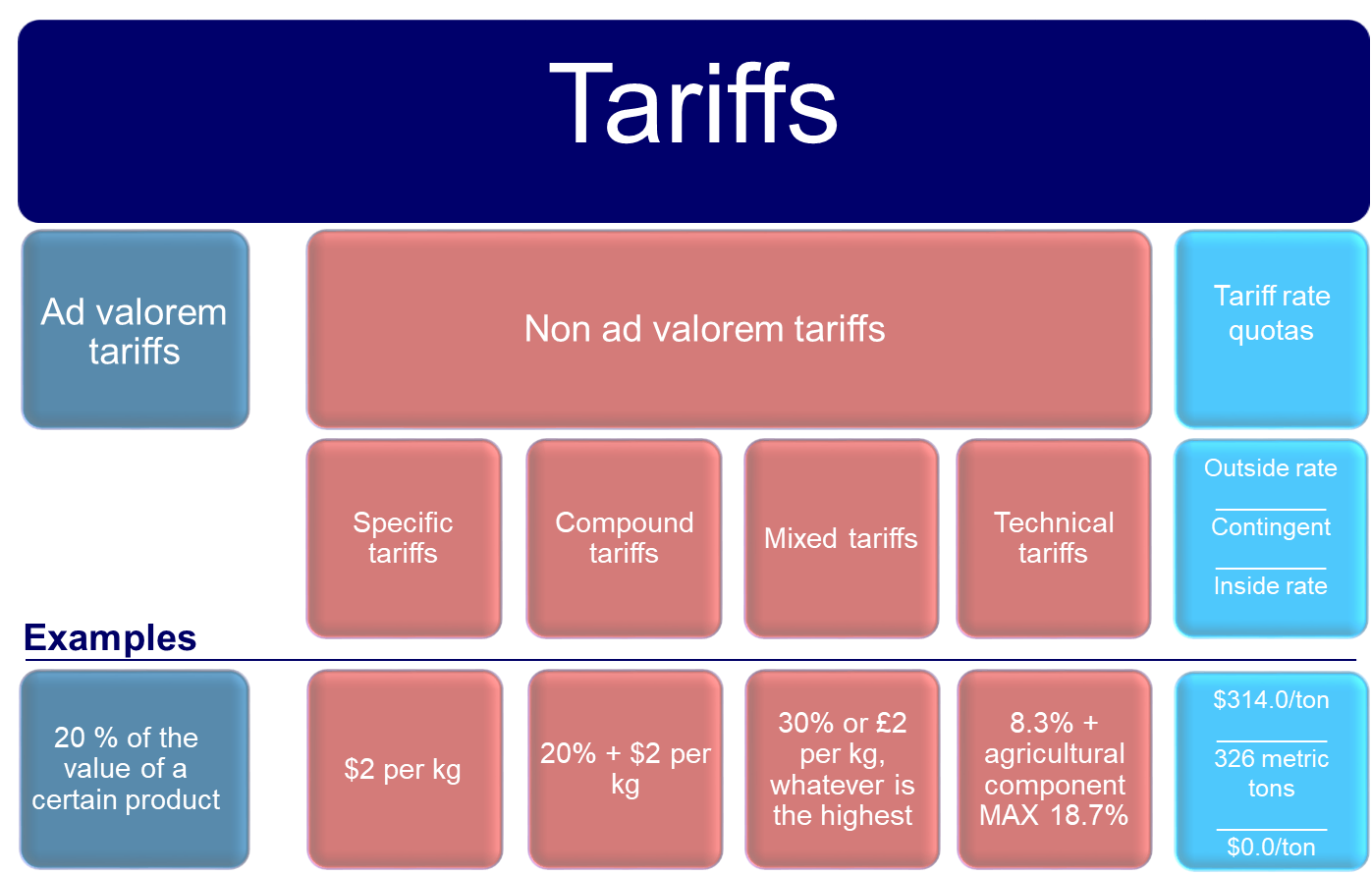

Most customs tariffs are ad valorem, which means that they are expressed as a percentage of the value of the good.

However, some duties, known as specific tariffs, are computed based on the physical quantity of the good such as weight or volume. Other forms of tariffs include a combination of ad valorem and specific duties or even more complex duties that include product-specific technicalities.

Finally, Tariff Rate Quotas (TRQ) are two-tiered tariffs. The first level of tariff (inside-quota tariff) applies to a specified quantity of import. Once this quantity limit (contingent) is reached, a relatively higher customs duty (outside-quota tariff) is levied on the imported goods. The outside tariff rate must be within the bound tariffs.

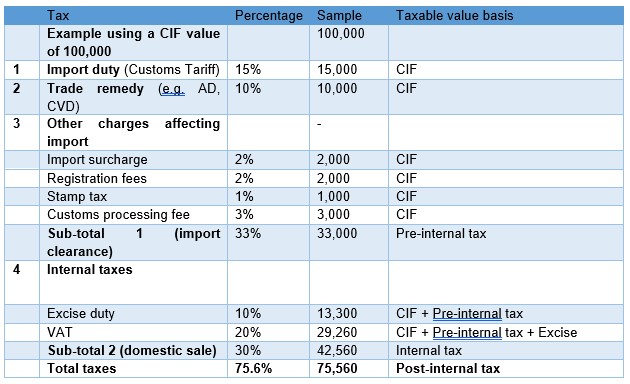

The following chart resumes the different forms of tariffs and provides typical examples.

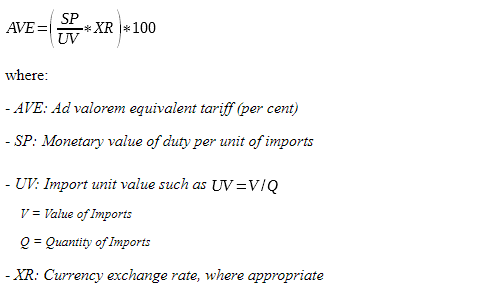

Ad valorem rates are generally more transparent and easier to understand than specific ones. For this reason, Market Access Map computes Ad Valorem Equivalent (AVE) of specific rates and display AVEs alongside the reported tariffs.

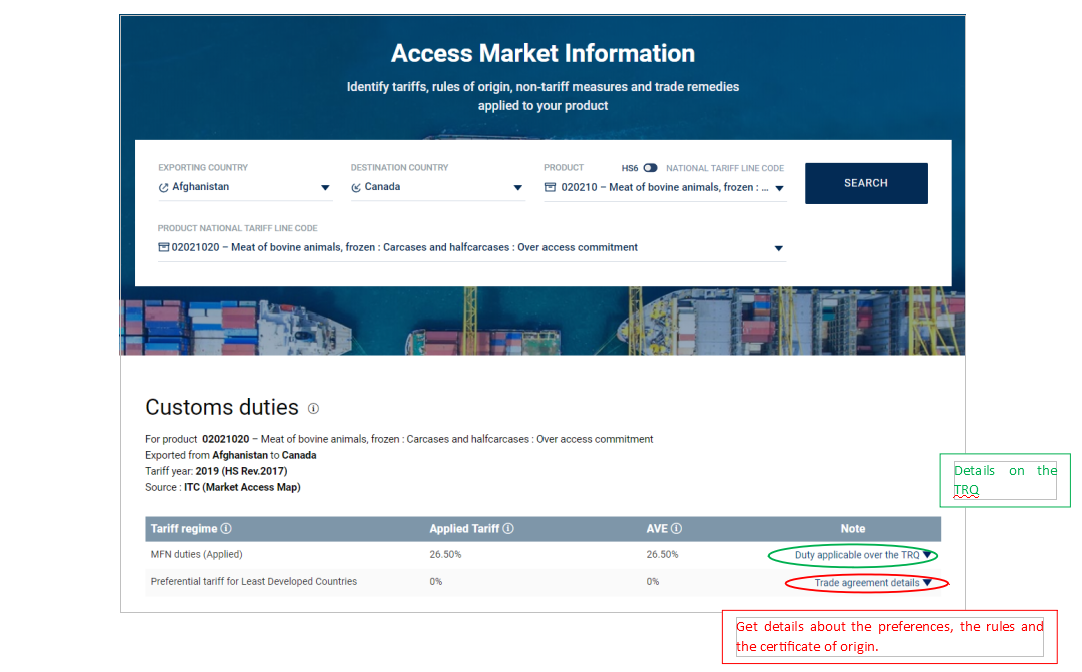

Determining the amount of duties imposed on imports involves several steps. First, the customs authority must determine the country of origin, to decide whether the imported product is subject to the MFN or a preferential duty rate, depending on the rules of origin. The second step is to identify the duty rate from the tariff schedules of the importing country, based on the product HS classification. The third step is to determine the dutiable value, unless the tariff is specific.

Any user can easily complete the first two steps using Market Access Map.

Please note that detailed and historical tariff data can be retrieved through the Access/Customs Duties sub-module.

Moreover, Market Access Map offers functionalities to view and analyse tariffs either imposed on goods in all world destination markets (Compare Markets) or applied to all competitors in a given importing country (Compare Competitors). A comparison across products is also possible for a given exporter-importer pair (Compare Products).

Finally, interested users can download a large volume of tariff data in the Download module.

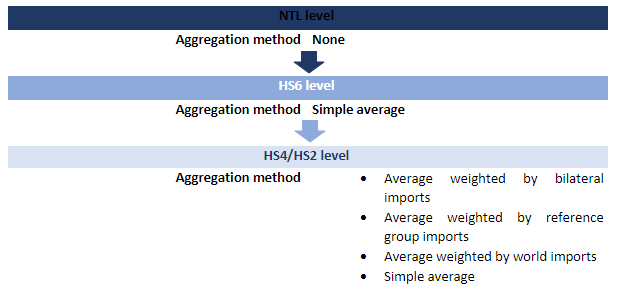

Governments impose customs tariffs at the level of ‘National Tariff Lines’ (NTL), which means codes are longer than the six-digit level of the Harmonized System. At this very detailed level, comparisons across countries are not always possible as NTL codes used to define products may differ. Therefore, aggregation from the NTL to the HS6 or upper levels may be necessary.

-

1. Aggregation from NTLC to HS6

The aggregation technique used to obtain tariffs at the HS6 level is a simple average of all best NTL tariff rates comprised in this HS6 code.

For a given NTL, the best tariff rate or the effectively applied tariff is the minimal tariff among the MFN, the general (if applicable) and all preferential tariffs (if any).

-

2. Aggregation from HS6 to upper levels

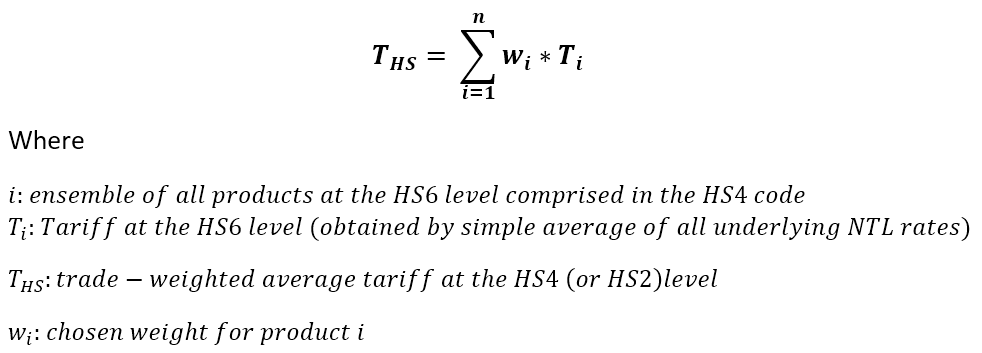

Two techniques are used to aggregate tariffs from HS6 to HS4 and/or HS2: simple average or trade-weighted average.

By default, Market Access Map prioritizes the trade-weighted approach, which is expressed as following:

Market Access Map proposes three trade-weighting methods: bilateral imports, reference group imports and world imports. However, Market Access Map uses the reference group imports weights by default.

-

a. Trade weighting using bilateral imports

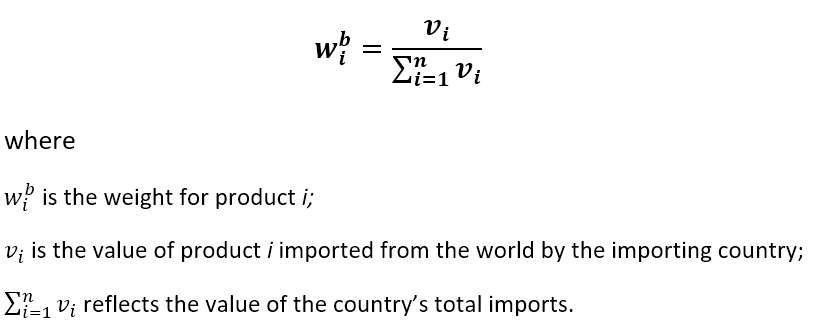

The country’s trade pattern with its partners weighs the underlying tariff rates. The bilateral weights are computed as following:

As a result, products with high import values receive a bigger weight in the aggregation. Nonetheless, this method suffers from an endogeneity bias, as the import values used in the weights may depend on the tariffs themselves. In fact, the level of tariff protection imposed on a product may influence the value imported of that product. On one hand, high tariffs may hinder imports, lowering the tariff rate’s contribution to the average tariff that is supposed to reflect the overall protection level of the product group. On the other hand, low tariffs may translate into higher imports, contributing disproportionally more to the aggregate.

Consequently, weighting the average tariffs using bilateral import values as weights may lead to a biased estimation of a country’s aggregated tariff level. Market Access Mapproposes two alternate methods to control for this endogeneity: weighting based on the reference group imports or on the world imports.

-

b. Trade weighting using reference group imports

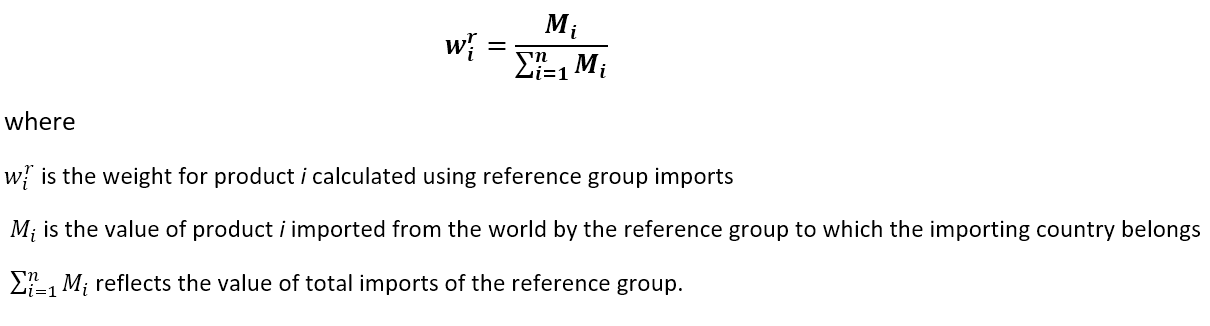

This technique controls for much of the endogeneity bias resulting from a simple import-weighted averaging. The import values of a reference group are used instead of those of the country itself.

Under this method, the weight is calculated as:

By construction, the weights are identical for all countries within the same reference group.

-

c. Trade weighting using world imports

When tariffs are aggregated using world imports, the weights are equal for any country. Market Access Map recommends this approach when running analyses that involve cross-country comparison.

-

1. AVE of non-ad valorem tariffs

Ad Valorem Equivalent is an estimation in form of a percentage of Non-Ad Valorem (NAV) tariffs. In Market Access Map, the general formula to compute the AVE is as following:

Market Access Map manages to compute AVE for most Non-Ad Valorem duties. (Table1)

Table 1: AVE composition of Non ad valorem duties Type of Duty Example Final AVE composition Specific tariff $2 per kg AVE of the specific tariff Compound tariff 10% plus $2 per kg Ad valorem component to which is added (or subtracted) the AVE of the specific component Mixed tariff 30% or € 2 per kg, whichever is highest Conditional choice (minimum or maximum) between the AVE of the specific component and the ad valorem component. Technical tariff 9% on dairy spreads with a fat content between 39% and 60% No AVE For some type of customs duties, the computation of AVE is not always possible, mainly due to the lack of information on product technical specifications. Table 2 provides examples of such technical duties.

Table 2: Examples of technical duties Importing country National Product Code Product Description Custom duty as reported Yemen 220430000 Wine of fresh grapes, including fortified wines; grape must other than that of heading 20.90: Other grape must Prohibited Russian Federation 8703329093 Motor cars and other motor vehicles principally designed for the transport of persons (other than those of heading 8702), including station wagons and racing cars: Other vehicles, with compression-ignite 2.2 euro per cm3 of engine volumn New Zealand 95081000 Roundabouts, swings, shotting galleries and other fairgound amusements; travelling cicurses and travelling menageries; travelling theatres: Travelling ciruses and travelling menageries The rates applicable to the separate components United States 91091010 Alarm clock movements, complete and assembled, electrically operated, with opto-electronic display only 3.9% on the movement + 5.3% on the battery -

2. AVE of Tariff-Rate Quota (TRQ)

Market Access Map displays both the TRQs reported by importing countries and their ad valorem equivalents. AVE calculation of TRQ takes into account the real volume of import, i.e. the sum of import quantities of products (at the tariff line level) subject to the TRQs from beneficiary countries.

The AVE estimates depend on the method of TRQ administration.

- The AVE is equal to the inside tariff of the TRQ if the administration method is one of the following: “Applied tariff”, “Licenses on demand”, “Auctioning”, “Historical Importer”, “ Imports undertaken by state trading entities”, or “Import undertaken by producer groups or associations”.

- For any other methods of administration, the AVE of TRQ consists of :

- The average of the inside and outside tariff rates if the import volume is less than or equal to 80% of the quota volume.

- The outside tariff quota if the import volume is above 80% of the contingent.

- The outside tariff quota if the import volume is above 80% of the contingent.

-

3. Estimation of the Unit Value (UV)

The main challenge in the calculation of AVE is to estimate the accurate UV. In fact, UVs can be calculated for each partner separately or for a reference group:

- Global UV average: based on the sum of all (n) bilateral trade flows (i).

- Weighted UV average:

- Simple UV average: gives the same weight to all UVs.

- Median UV: based on individual bilateral UVs and uses the median UVs.

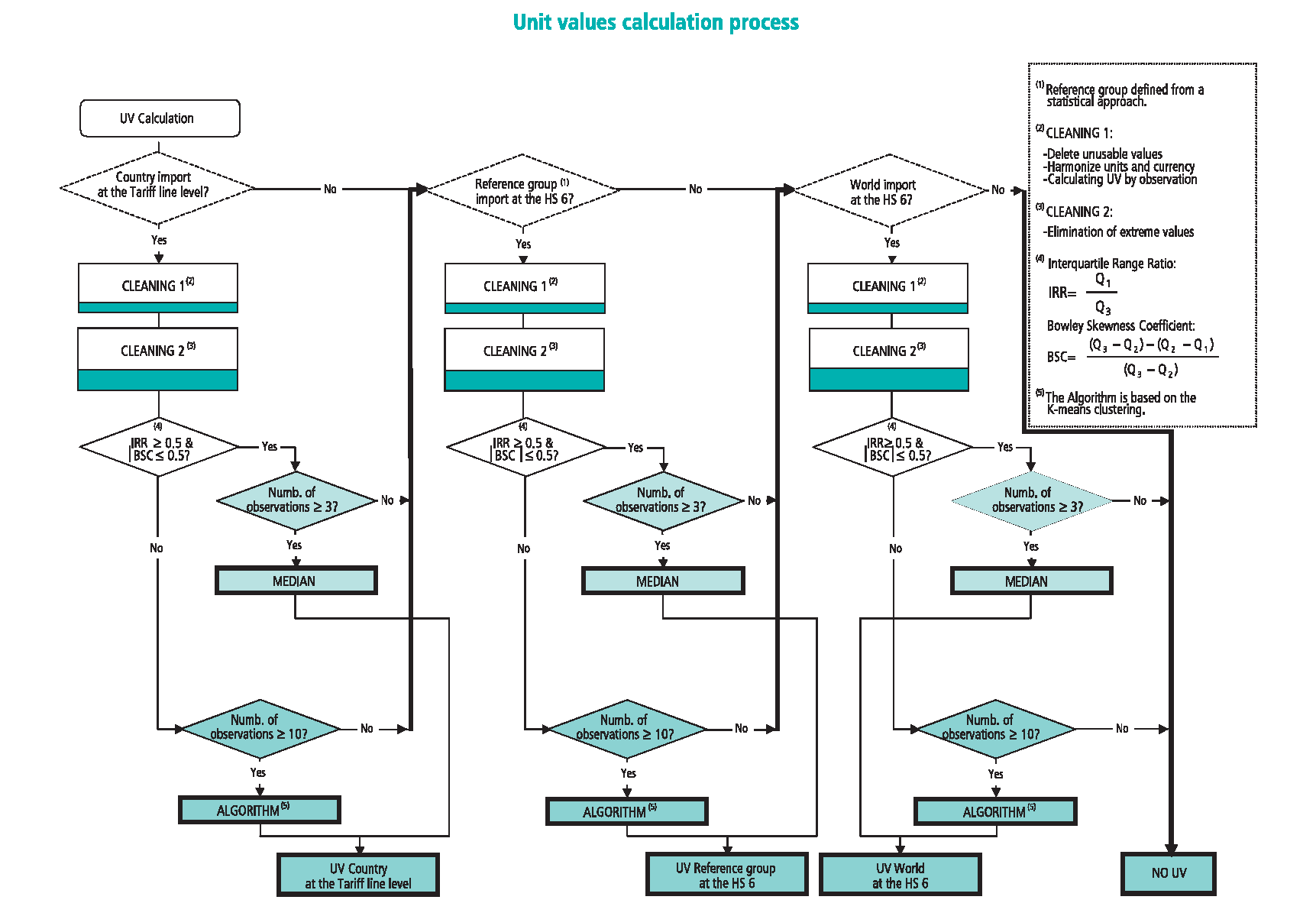

The most accurate estimates of AVEs depend on the sensitivities to variations in the data. Figure 5 summarizes ITC’s approach to estimate UVs. For more detailed explanation on the methodology, please refer to the World Tariff Profile 2006, Technical Annexes A-C, pp. 179-204. Should you require any further clarification please do not hesitate to contact us at marketanalysis@intracen.org.

- Global UV average: based on the sum of all (n) bilateral trade flows (i).

-

1. Data collection

Data in Market Access Map is collected directly from key institutions such as Ministries (Foreign Affairs, Finance and Trade), Legislative Bodies, Specialized Directions (Customs Services, Taxes Directions and Revenue Authorities), Permanent Missions to the United Nations and to the World Trade Organization, as well as Regional Institutions. Market Access Map, through its team of data collectors, is in permanent contact with these institutions thanks to National Focal Points (NFP).

NFPs regularly submit any relevant national legislations that contain information on customs tariffs and any form of internal taxes. They also send notification as soon as amendments to legislations come into force.

Market Access Map extracts customs duties from the collected official documents. The extracted content are then cleaned, formatted and compiled using advanced techniques of data manipulation and treatment in line with the state of the art methodologies for processing of international trade-related data. The later include the conformity with the Harmonized System commodity classification, the identification of duty types (ad valorem, non-ad valorem or tariff rate quota), the determination of the dutiable amount (CIF, FOB or composite value), and other requirements.

The final step before uploading the final data on the application consists of a series of verifications in order to assure the quality, the correctness and the completeness of the data.

-

2. Data update

Market Access Map updates tariff data once a year. However, there might be situations that require immediate update so Market Access Map team does it best to integrate those amendments. Below, we list situations that may trigger a verification and necessitate an update.

- Situation 1: New fiscal year.

Fiscal year differs across countries. Some countries follow the calendar year to update their tariffs and taxes; such is the case of most countries. Some follow their national fiscal calendar, which is the case of Japan for example. In this situation, updates are mandatory as long as we have received the data from our NPFs.

- Situation 2: The conclusion, ratification and entry into force of a new trade agreement

- Situation 3: Changes in customs duties or national taxation from:

- National Legislation, Official Journal, and newspapers.

- Amendments to trade agreements, customs duties or taxes announced by countries. Customs and Tax departments regularly provide updates on taxes or customs duties.

- Situation 1: New fiscal year.

-

3. Data availability

Since 1996, the Trade and Market Intelligence section of ITC is specialized in the creation and dissemination of trade-related databases. Among others, it maintains the Market Access Map database, which provides a comprehensive overview of the world’s trade protection policies.

Particularly, Market Access Map contains current and past general, MFN, and preferential tariffs applied by more than 200 countries and territories.

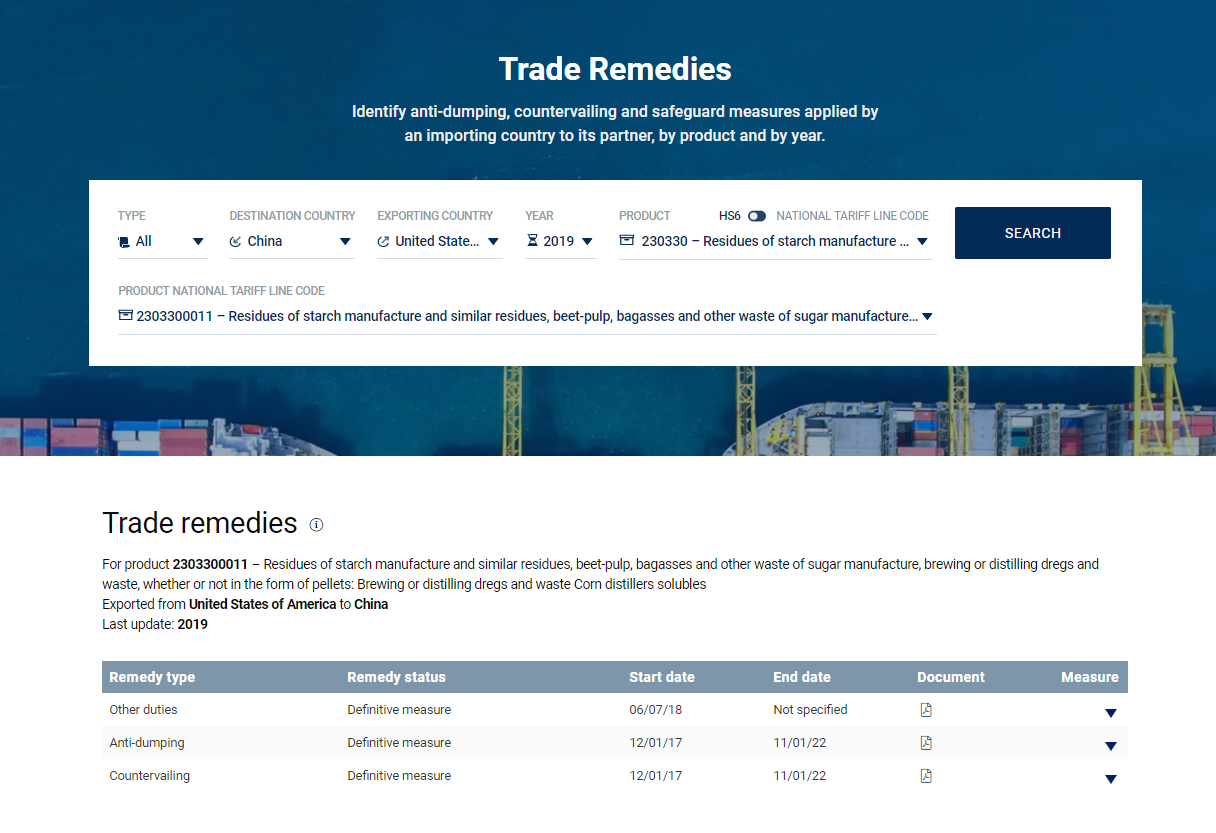

In addition, Market Access Map also covers other market access-related issues such as tariff rate quotas, non-tariff measures, rules of origin, and trade remedies.

In the database, tariffs are available at the most detailed national tariff line (NTL) level as well as at more aggregated level comparable across countries (HS6, HS4,HS2).

Finally, the availability of pre-calculated ad valorem equivalents of non-ad valorem tariffs allows cross country and cross product comparisons.

Please consult the Data Availability module for more details